Buyer’s Guide

Information is your best ally when buying a home and I make sure that you understand the process each step of the way. This starts with the ‘Buyers Consultation’.

I believe in a partnership where we work together, from start to finish. You should never be in the dark at any point in the process.

We will make sure you thoroughly understand everything that is going on all of the time while providing the transparency you deserve.

The home buying process has many moving parts that can be overwhelming if caught off-guard. We know that constant communication makes this a much more enjoyable process so you can spend more time being excited about your new home.

In our conversation, we will talk through the different steps of the process and in what order we need to do things. We will talk about the current market conditions, interest rates, and what we are seeing in the market you are interested in. We will look at all the different options available to you as a buyer ensuring all possibilities are on the table.

Besides all that we will get to know each other a little bit and I believe that goes a long way in working together towards a successful goal!

Determining all the things that are important in your new home and getting on the same page with other household members is essential to finding the home that’s right for you. Save time, search more efficiently, and only see homes that fit your needs and wants.

Deciding whether to move forward or to step away from any given home comes down to 3 things.

- Your Must-Haves

- Your Dealbreakers

- Items of Compromise

Trying to sort this out on the fly makes an already challenging process much more so.

It’s exciting to start one’s home search as it very well should be. But taking a moment before getting started to sit down and talk through a ‘Buyers Needs Analysis’ will save you so much time and keep the process both fun and effective. It will help you to identify and narrow down the things that are most important. It will also help you to know what to avoid.

Through time and experience, we have come up with the right questions to ask which will guide you and I in making a blueprint of your perfect home.

This also gives us the insight needed to target only homes that will work and avoid spending time on ones that don’t.

Working together with all the right information will lead us to the place you will call home.

Why should you get pre-approved? Simple – to determine what you can comfortably afford. It also allows us to move quickly when we find the right house in a hot market.

If you haven’t experienced it before, the home loan process can feel overwhelming, and something many buyers often put off. The right lender will make this part of the process painless and educational which will empower you in knowing where you stand and what your home search looks like. The first thing to do is consult with a mortgage specialist (or two). If you don’t already have someone in mind, I partner with some of the best lenders in the industry, and am happy to introduce you, so you’ll be taken care of.

Before you start looking for a home to buy, we want to get pre-approved for a loan. There are a variety of different loan programs, so make sure to get pre-qualification for the specific programs that best suit your needs.

A good loan officer will be like a financial advisor and will work with you to identify your ideal price point which will help us identify the best property for you.

The first step in buying a new home is for us to identify the neighborhoods you want to live in. Save your favorite homes, then add them to a collection – where we can comment and collaborate.

Investing in a home is one of the most important decisions you’ll make. So much more than a roof over your head, your home is where life unfolds and memories are made, while building a financial foundation for your future.

Your needs drive how and when we find your next home. From this day forward, everything I do will be motivated by your goals and how you imagine your life in this new environment. After reviewing your buyer’s needs analysis, finding your dream home will move faster and with minimal interruption to your daily life.

I will be putting together a very detailed and targeted search with all the criteria we’ve gotten from you and through our KW listing service and our local MLS and will find, screen and send you homes for you to review.

Your feedback is very important as I send you homes and as we go out touring homes. The more honest you are with your feedback the better I can really dial in on exactly what you are looking for.

Let’s arrange to visit the homes you’re most interested in, to determine the best fit for you. Homes can sometimes appear very different online than they do in person

I have a process for how we tour homes. This process will ensure you look at and compare each home equally. It will also help you to keep clear the different homes you saw. It can very easily get very confusing after seeing several homes and not uncommon for buyers to start to blend together the homes they see. My process helps to avoid that.

What should I look for when visiting homes?

- Look beyond the staging and decorative items to see the features and fixtures that convey with the house.

- Check the condition of the home.

- Keep track with photos and notes.

- Consider possible home improvements you might want to make so you can research costs later.

- Don’t forget to check out the outside of the property and the neighborhood. I have access to relevant neighborhood insights and data to help inform your decision.

- Locate your commuter route, schools, shops, restaurants, parks, and other amenities.

- If the property is a condo or located in a homeowners association, we’ll assess the fees and rules to see if you can live with them.

As your trusted partner for your home search, feel free to reach out at any time should you have any questions about any of the homes we tour.

Once you’ve narrowed down your list and have a clear favorite, we’re ready to make an offer on a home.

After you’ve found the one, I’ll evaluate the market and draft a well-thought-out offer that also protects your interests.

What should I look for when visiting homes?

Your offer will be written using the most recent legal purchase forms and addenda that comply with all state and local laws.

Your offer will include:

- Pre-Approval Letter

- The price

- Terms

- Target date for closing

- Seller disclosure acknowledgment (after detailed review)

- Earnest money deposit (I can advise you about how big your deposit should be based on local markets and current conditions)

- Request for final walk-through

- Time limit for the offer

What are the most common contingencies?

This should have Financing, Appraisal, Inspection, Title. A short bit about each and that we will talk in detail about each of these prior to starting your home search.

- Financing - Unless you’re paying cash, it’s typical to write your offer with a contingency clause that provides you with an out if you can’t finalize your mortgage within a certain number of days. Even though you have a pre-approval for a loan, it’s smart to protect yourself.

- Home inspection - Your offer can be made dependent on a satisfactory home inspection report within a certain number of days. This protects you if the inspection uncovers expensive necessary repairs.

- Title - Ensuring the title is clear and transferable.

What happens if I face multiple offers?

In a hot housing market, you may find yourself competing against other buyers. If that’s the case, I will work on your behalf, strategizing for your offer to be accepted. With access to real-time market data, I’ll know how to best position your offer.

If there’s more than one on the table, the seller can:

- Accept the best offer

- Counter all the offers to get a better price and terms

- Counter one offer that’s close to what they want

Working to find out what’s truly important to the seller while developing a good working relationship with the agent on the other side, is often the key to winning multiple offers and often without paying the highest price. Discussing the risks vs rewards of waiving certain contingencies, adjusting your price, escalation clauses, partial or full earnest money release, the pro’s and cons to writing a “love letter” about the house are some of the options we can consider when facing multiple offers.

Don’t worry, we will talk through all these options so you can make informed decisions and know what we are doing and why.

What is a counteroffer?

The seller can accept your offer as is, or they can make a counteroffer with an adjustment to your terms. You can accept or reject the counteroffer and make your own counteroffer back. The contract is final once you and the seller have agreed to all terms.

As a CNE Certified Broker, I go above and beyond the un-trained agent and utilize the top strategies and negotiation skills to get you the best result possible. Negotiations are the most important part of any business transaction, especially when dealing with the largest purchase of your life.

I’ll always work in your best interests.

CNE = ‘Certified Negotiations Expert’ is a nationally recognized certification who’s curriculum comes from Stanford, Harvard and Wharton schools of business and law.

Of the almost 2 million agents in the U.S., only .2% have this level of negotiation training. Don’t gamble with this amount of money and with the place you want to call ‘Home’. Sadly we regularly see 6 figures left on the table by LSA (Limited Service Agents) who;s only strategy is to throw as much of their clients money at an offer as they can.

I’m ready to help you navigate all of the steps that lead to a successful close.

The crucial period between an offer and a final contract is an important time to stay in close contact with me, so you’re equipped with all the information you need to make smart decisions.

What should I expect to see in the contract?

Some of the key points in your multipage contract include:

- Accuracy of information, including the correct spelling of your name and the property address.

- The effective date of the contract – important because your contingencies have time limits.

- A list of contingencies, such as that the sale depends on financing, an appraisal, a satisfactory home inspection, and perhaps the sale of your current home.

- Property disclosure information from the seller, depending on your state laws.

- A complete list of what conveys with the property.

- A list of required inspections, such as a home inspection and a pest inspection.

- Information about when you can move in.

- In some cases, such as if your offer is contingent on the sale of your home, the seller may add a “kick-out” clause, which means that the seller could accept another offer if one is made before your home is sold.

I’ll review the contract with you to make sure all of your questions are answered.

How do I know when to negotiate and when to let go?

Know your BATNA. ‘Best Alternative To a Negotiated Agreement’ Important step that we will go over together.

We’ll work together to balance how much you want a particular property and what you’re willing to accept to get it.

- You may want to let go when:

- A bidding war drives the price too high.

- The appraised value of the home is below your offer.

- A home inspection finds defects that would be expensive to repair.

- The seller is unwilling to make reasonable repairs.

- You learn about homeowners association rules that won’t work for you.

What are common contract pitfalls I should avoid?

We’ll watch out for:

- Unrealistic deadlines: you’ll need time to arrange a home inspection and receive the report, as well as arrange financing. Change to as well as time needed to complete financing.

- Missing deadlines means you lose your chance to end the contract and keep your deposit. Change to keep your Earnest Money

- Communications from your lender.

According to the National Association of REALTORS®, the most common reasons for contracts to fail or be delayed are home inspection problems, financing problems, or an appraisal issue. I will be by your side at every step to help you navigate the complexities of a real estate contract.

A professional home inspection, which discloses vital information about a home, is a must before finalizing your purchase.

As soon as your offer is accepted, we’ll schedule your home inspection. I have a number of trusted home inspectors we can turn to.

What is a home inspection?

Your home inspection will be a very thorough check the home’s systems, appliances, and structures in your home to evaluate its condition. You’ll get a written report that identifies potential problems and future maintenance issues. We’ll look at it together to decide whether the report means you want to walk away from a house or ask the sellers to make repairs. You can also have an “information only” inspection, which means you’re buying the house as is, but want to know its condition.

What’s included in a home inspection?

The inspector will check:

- Structural conditions such as the foundation, beams, and floors.

- Roof condition.

- Mechanical systems such as heat and air conditioning.

- Appliances – to make sure they’re working.

- Plumbing – for leaks, rust, and water pressure.

- Electrical systems such as grounded outlets and code violations.

- Safety issues such as stairs, handrails, mold, or chimney maintenance.

What should I watch for during the home inspection?

Together, we’ll attend the home inspection to learn more about home maintenance and so you can see any potential problems yourself. The inspector can answer questions as you go, so if there’s anything you don’t understand or are worried about, just ask.

How do I know when to negotiate and when to let go?

We can decide whether to negotiate on anything in the inspection report and ask the inspector the following questions:

- Are the items you’ve flagged major or minor issues?

- What needs to be done to resolve any flagged issues?

- Can you give me an estimate of the cost of any repairs?

- Do I need another inspection, such as by an electrician or a structural engineer?

- Are there things I need to do after I move in?

I’ll be your partner in helping you understand the implications of the home inspection.

Due to current ‘Stay Home’ order Inspections can take place but buyer and seller are not allowed to be at the home during the inspection. Inspector will follow up with call and go over report and pictures and will send over detailed report for us to review.

Home insurance protects your new home and belongings from accidental damages. Make sure you insure your home with a plan that fits.

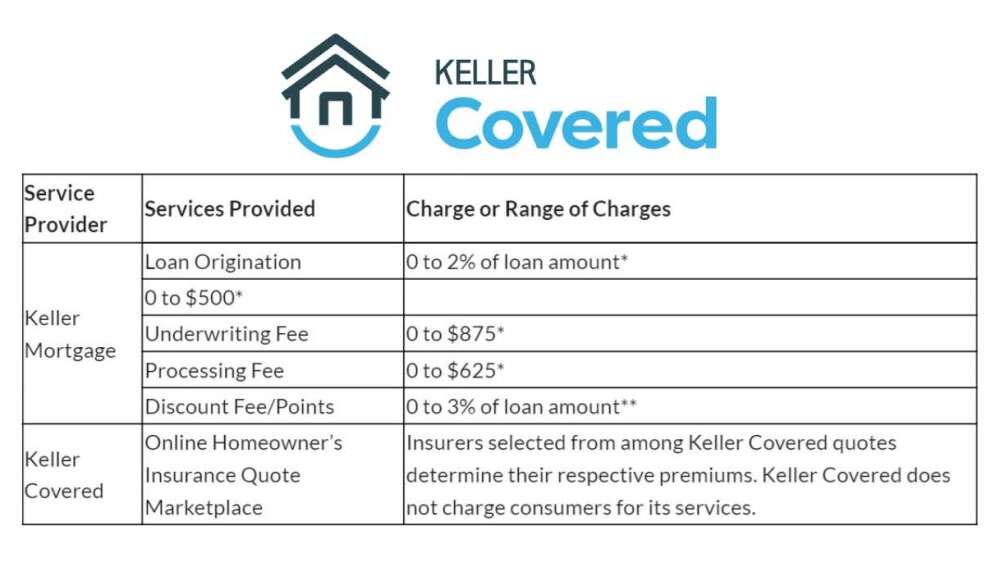

KELLER COVERED

AFFILIATED BUSINESS ARRANGEMENT DISCLOSURE

Please read and acknowledge below.

This is to give you notice that the Keller Williams Market Center, with which your agent is affiliated, has a business relationship with Keller Mortgage, LLC (“Keller Mortgage”) and KW Insurance, Ltd. (“Keller Covered”). Certain officers, directors, and owners of Keller Williams Realty, Inc. (“KWRI”), the Keller Williams Market Center franchisor, have indirect ownership interests ranging from an estimated one to 70 percent in Keller Mortgage. Likewise, certain officers, directors, and owners of KWRI have direct and indirect ownership interests ranging from an estimated one to 83 percent in Keller Covered. Because of these relationships, this referral may provide KWRI and/or officers, directors, or owners of KWRI a financial or other benefit.

Set forth below is the estimated charge or range of charges for the settlement services listed. You are NOT required to use the listed providers as a condition for settlement of your loan on or purchase, sale, or refinance of the subject property. THERE ARE FREQUENTLY OTHER SETTLEMENT SERVICE PROVIDERS AVAILABLE WITH SIMILAR SERVICES. YOU ARE FREE TO SHOP AROUND TO DETERMINE THAT YOU ARE RECEIVING THE BEST SERVICES AND THE BEST RATE FOR THESE SERVICES.

* No loan origination, application, underwriting, or processing fees are charged in transactions involving a Keller Williams agent.

** The loan discount fee/points are affected by the interest rate on your loan and may be higher if your interest rate is below market. In addition, the lender may require that you pay for the services of an attorney, credit reporting agency, or real estate appraiser chosen by the lender to represent the lender’s interest.

Secure a home warranty to maintain the essential, major systems and appliances that can be costly to repair out of pocket.

Some home sellers pay for a home warranty that covers them while their home is on the market and conveys to the buyers after the sale. We can work together to determine whether we should negotiate for the seller to pay for a warranty or buy one yourself.

What is a home warranty?

A home warranty policy, which typically lasts for one year and is renewable, provides coverage for some of your home’s systems and appliances. In return for the annual fee, the company will cover repair costs and arrange for contractors. You’ll pay a deductible fee and possibly service fees if you need to use the warranty

Do I need a home warranty?

If you’re buying an existing home, especially one with appliances that are more than four years old, a home warranty can give you peace of mind about paying for unexpected repairs and finding a reliable contractor. If you’re a first-time buyer, especially if you have limited savings, this can be particularly important.

If you have plenty of emergency savings, you’re handy, or you know good contractors, you may not need a warranty. You can count on me to provide referrals for recommended contractors.

If you’re buying a newly built home, structural defects are usually under warranty by the builder for 10 years, and other items are typically covered for six months to two years, so you don’t usually need a home warranty.

What should I look for in a home warranty?

- To choose a good home warranty, we will review:

- The home warranty company’s license with your state’s real estate commission

- The fine print – that’s where you’ll find exclusions and limitations

- What’s covered and what’s not

- The coverage limits – your repairs will only be paid for up to a specific level

- Service fees and deductibles

- How quickly service and claims are handled

- How contractors are vetted and what happens if you use your own

- Coverage differences between a basic warranty and enhanced warranty

- Online reviews

Your new home is close at hand! Let’s get ready to gather the required documents, sign the paperwork, and hire a mover.

There’s no need to feel jittery before your closing as I will have you fully prepared for the day.

What should I do before the closing?

We’ll stay in close communication to make sure that your questions are answered and you feel ready to sign on the dotted line. As your closing day nears, keep this list handy:

- Stay in close touch with me, your lender, and title/escrow company.

- Avoid lowering your credit score with a new credit application or late payments.

- Confirm that your contract contingencies are resolved, including the home inspection, an appraisal, and your financing.

- Finalize your homeowners insurance policy.

- Gather your down payment and closing-cost funds in an accessible account.

- Review your closing disclosure form, which you’ll receive three days before your settlement, and ask questions if you don’t understand something.

- Arrange a wire transfer or get a cashier’s check for the funds you need for the settlement.

- Schedule a walk-through of your new home within 5 days before your closing to check that everything is at it was and anything agreed upon was taken care of.

What can I expect at the closing?

We’ll be finalizing all of the paperwork to close on the sale of your new home. You will want to allot a few hours for your closing.

Bring to the closing:

- A government-issued photo ID

- Proof of homeowners insurance

- Your cashier’s check or wire transfer confirmation

What’s next?

After your closing:

- Keep all your signed documents in a safe place.

- Change your address.

- Change the locks and security codes on your home.

- Review your due dates and new budget.

Congratulations! You’ve got the keys to your new home!

After your purchase, you will always have full access to my list of professional contacts should you ever need anything from a handyman, painter, plumber, contractor, or an attorney. Just let me know and I have you covered. Further down the road, should you ever want to sell, I’ll have the scoop. You’ll always have my number, and I’ll always be ready to step in and help with anything you need. I not only want a client for life but hope that it can become a friendship as well.

At the end l would like to say. “The one favor I will ask of you is if I did everything I said I would do for you, and you felt I did a great job in helping you with your real estate needs is that you write me a review on my google business page and that you refer me any friend, family or colleague that is looking to buy or sell real estate. This is the greatest thanks that I can receive.